(VIDEO) BUDGET: Breaking Down Proposition #1

May 9, 2017

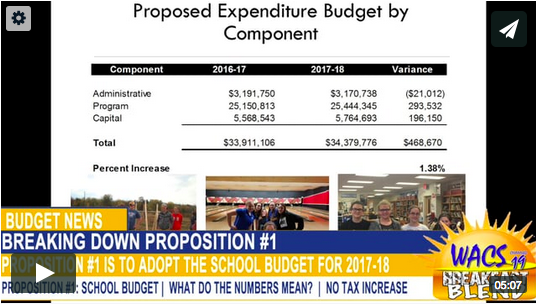

When all the propositions of the proposed budget are factored together, the projected revenue for the 2017-2018 school year is up $468,670 from the 2016-2017 school year. One reason the budget will not increase property taxes for the third consecutive year is largely in part because of pensions. CPA Mr. Paul Karpik, the District Business Administrator, said that when the stock market performs well, as it currently is, pensions don’t increase, so they have less of an impact on the budget.

In the the projected expenditures for the next school year, the salaries of any employee providing student services increased, but in the category of Administrative Components, there is a decrease of $21,012. The salaries of these employees, administrative and clerical staff, decreased due to Mrs. Monacelli’s retirement and an unfilled position n the District Office which was there fore removed from the budget.

Items that fall under “Contractual” expenses include a very wide range of services, whether it be special education services, officials for athletic events, maintenance contracts, or insurance. As for “debt service,” these expenditures include paying serial bonds for different projects the district undertakes. Serial bonds are bonds that don’t mature on a single date, but rather, at intervals over time. For this year, this expense is composed primarily of renovations 2014 costs, but is offset by increased state aid.

To get a clearer picture of what falls under the category of “BOCES,” these items have a massive impact because they include things like Harkness programs for the high school, new technology and software for all students, and special education services as well . Mr. Karpik said the state partially reimburses the district for purchases made through BOCES–not including special education services because they aren’t eligible for reimbursement–so it is actually a huge advantage for the district to make these purchases through BOCES.

As for the Capital Reserve Fund (Proposition 4), the fund cannot exceed eight million dollars. It also has no impact on taxes because the the money that goes into the fund comes from surpluses that arise in the District throughout the year.

If the proposed 2017-2018 budget is rejected by voters, the District can then adopt its Contingency Budget. This budget would feature large reductions in all Non-Health and Safety equipment. For example, the District plans to purchase new music equipment next year, but this expense would have to be cut out of the contingency budget, if the originally proposed budget, which has a zero percent property tax increase, were to be rejected.